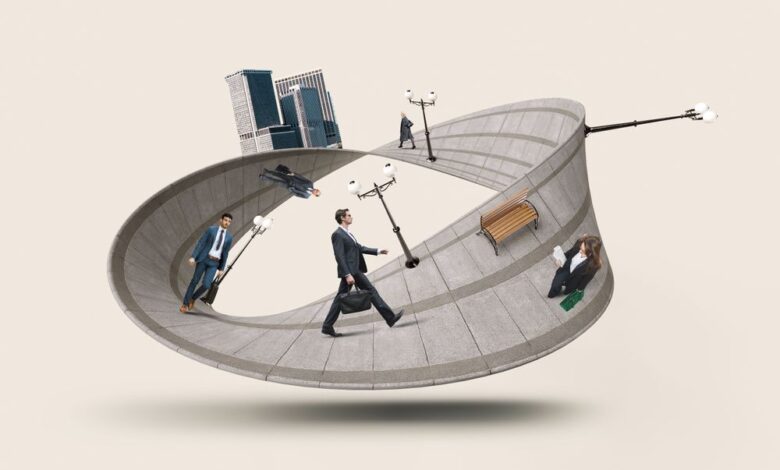

Navigating Through Turbulence Towards Growth

The semiconductor sector, a linchpin in the technological revolution, is undergoing a period of significant transformation. This industry, responsible for the microchips that power a vast array of devices from the ubiquitous smartphone to the sophisticated electric vehicle, has been grappling with a series of challenges. These challenges have been exacerbated by a global health crisis that has disrupted supply chains on an unprecedented scale. The shift towards remote work and the increased reliance on digital solutions have further fueled a surge in demand for electronic devices, leading to substantial production backlogs for these critical components.

According to the Semiconductor Industry Association, the global market for semiconductors has experienced a downturn, with chip sales witnessing a decline of around 22% in the current year as compared to the figures from the preceding year. As of April, the industry has reported sales amounting to $40 billion, which, despite being a slight improvement from the prior month, pales in comparison to the $50.9 billion recorded in the same month of the preceding year. While regions such as China and Japan have seen sales upticks, other areas including Europe, Asia and the Americas have not been as fortunate. However, the horizon seems promising with forecasts suggesting a near 12% growth in the following year, with the Memory segment expected to be a significant growth driver.

The value of the semiconductor market, which stood at nearly $528 billion in a recent year, is projected to soar to approximately $1381 billion within the next seven years. This anticipated expansion is largely fueled by the growing dependence on the internet-of-things and the strides being made in fields such as artificial intelligence, machine learning and cloud computing. Insights from a KPMG survey, which encompassed the perspectives of over 150 executives within the semiconductor realm, indicate that 81% are optimistic about revenue growth as the supply chain begins to stabilize in the current year. Mark Gibson, the Global Sector Head of Technology, Media & Telecommunications at KPMG International, regards this revenue outlook as a sign that the industry may soon be overcoming the inventory surplus, signaling a potential easing of supply chain woes.

The performance of semiconductor ETFs, particularly the Direxion Daily Semiconductor Bull 3X Shares (NYSE:SOXL), is a testament to the keen interest in the industry’s market movements. This ETF, which seeks to deliver thrice the daily performance of the ICE Semiconductor Index, has been a notable player since its inception over a decade ago, with an expense ratio of 0.94%. It is recognized as one of the premier semiconductor ETFs, tracking the daily returns of 30 leading semiconductor firms.

Within this ETF’s index lies Broadcom Inc. (NASDAQ:AVGO), a heavyweight in semiconductor manufacturing and services. The firm has captured the attention of hedge funds, with 72 expressing a bullish stance on Broadcom Inc. as of the second quarter of the current year. This consistent hedge fund interest underscores the strategic importance of Broadcom Inc. within the semiconductor landscape.

The semiconductor industry stands at a critical crossroads, with its future shaped by both prevailing challenges and emerging opportunities. The sector steers through supply chain disruptions and variable demand, its role as a catalyst for technological advancement and economic progress cannot be overstated. With the industry poised for a potential rebound and revenue growth in the near term, its resilience and capacity to adapt will be crucial. As our reliance on technology deepens, the semiconductor industry’s trajectory will undoubtedly be a focal point for stakeholders and observers alike.