Navigating Current Realities: A Close Look At JetBlue, Enphase Energy And Texas Instruments

$JBLU, $ENPH, $TXN

In the ever-evolving landscape of the corporate world, three companies, JetBlue Airways (NASDAQ:JBLU), Enphase Energy (NASDAQ:ENPH) and Texas Instruments (NASDAQ:TXN), stand out for their distinctive paths and strategies in their respective sectors. Each of these entities not only represents a unique facet of the American economic spectrum (from aviation to energy technology and semiconductors) but also illustrates the varied responses to contemporary market challenges and opportunities.

JetBlue Airways, a major player in the aviation industry, recently faced a significant downturn, with its stock price experiencing a notable decline. This was primarily due to the airline’s revised revenue forecasts, which fell short of expectations due to increased capacity and competitive pressures in its Latin American routes. The company’s strategic decision to exit less profitable markets and focus on high-margin areas demonstrates a proactive approach to refining its business model in response to shifting market dynamics.

Conversely, Enphase Energy, which operates in the renewable energy sector, particularly in solar technology, has shown resilience and adaptability. The company reported a decrease in quarterly earnings compared to the previous year, yet it continues to innovate and expand its product offerings. Enphase’s commitment to enhancing its micro inverter technology and expanding its battery storage solutions highlights its ongoing efforts to capitalize on the growing demand for renewable energy solutions, despite facing headwinds such as regulatory changes and market volatility.

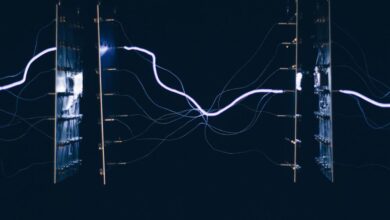

On the technological front, Texas Instruments, a giant in the semiconductor industry, has not been immune to the challenges of the global market. The company recently reported a decrease in revenue, driven by a downturn in demand across several key markets, including automotive and industrial. However, Texas Instruments’ extensive investment in research and development and its strategic focus on manufacturing capabilities suggest a long-term vision geared towards maintaining its leadership and meeting future technological demands.

Moreover, each company’s approach to navigating current market conditions reflects broader industry trends. JetBlue’s focus on cost management and network optimization mirrors the aviation industry’s ongoing struggles with fluctuating demand and economic uncertainty. Similarly, Enphase Energy’s investment in technology and product diversification aligns with the energy sector’s shift towards sustainable and resilient energy solutions. Meanwhile, Texas Instruments’ emphasis on innovation and efficiency resonates with the semiconductor industry’s need to adapt to rapid technological advancements and changing consumer preferences.

JetBlue Airways, Enphase Energy and Texas Instruments each illustrate the complexities of operating in today’s dynamic economic environment. Their strategies, whether focusing on refining business models, investing in innovation, or expanding product lines, reflect a deeper understanding of the need to remain flexible and responsive to the ever-changing market conditions. These companies continue to adapt and evolve, they not only contribute to their respective industries but also shape the broader economic landscape, highlighting the interconnectedness of business strategies, market challenges and technological advancements.