Dow Jones Industrial Average: A Snapshot Of Current Market Dynamics

$^DJI

The Dow Jones Industrial Average (INDEXDJX:.DJI), often referred to simply as “the Dow,” is a significant stock market index that represents the economic health of the industrial sector in the United States. Comprising 30 prominent companies, it serves as a barometer for the overall market performance, influencing economic policies and investor sentiment. Established in 1896 by Charles Dow, the Dow Jones Industrial Average includes leading corporations across various industries, making it a critical indicator for investors and analysts looking to understand market trends and economic forecasts.

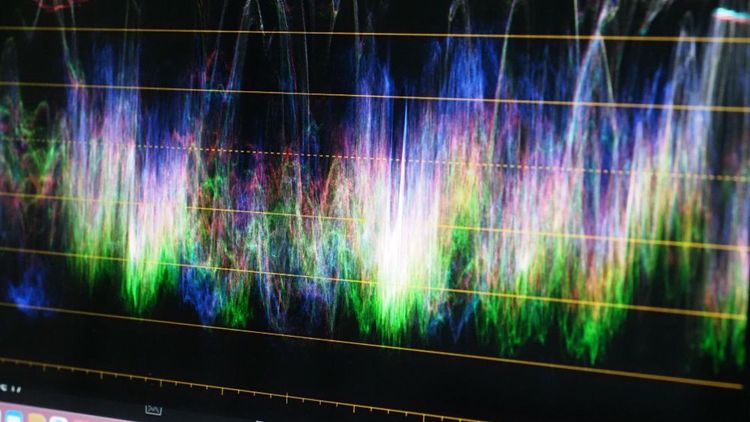

In the realm of financial indices, the Dow Jones Industrial Average (DJIA) remains a significant barometer of the overall health of the United States stock market. Comprising 30 prominent companies, the DJIA offers a glimpse into the industrial capabilities and economic resilience of these major corporations. As of the latest trading session, the index has shown fluctuations that mirror the complex interplay of global economic factors, technological advancements and geopolitical tensions. The DJIA’s performance is closely monitored by market analysts and economic strategists as it provides critical insights into the broader market trends.

The index’s movement is a composite reflection of the successes and challenges faced by its constituent companies, which range from legacy industrial firms to modern tech giants. Technological innovation continues to be a significant driver of change within the DJIA companies. These enterprises integrate advanced technologies into their operations, from artificial intelligence to renewable energy solutions, they not only enhance their operational efficiencies but also their market competitiveness. This technological pivot is crucial as it influences the index’s performance and, by extension, investor sentiment and economic forecasts. Moreover, the global economic landscape has imposed challenges such as fluctuating supply chain dynamics and varying consumer demand, which directly impact the performance of the DJIA companies.

These companies, emblematic of American industrial and technological prowess, must navigate these complexities to maintain their market positions. Their ability to adapt to these changes is not only indicative of their individual corporate strategies but also reflective of broader economic resilience. The DJIA provides a critical lens through which the economic and industrial health of the United States can be gauged. While the index’s recent performance reflects a tapestry of economic resilience and challenges, the ongoing adaptations and innovations by the constituent companies suggest a dynamic engagement with both current opportunities and potential future hurdles. These companies continue to evolve and respond to global economic stimuli, the DJIA will likely remain a key indicator of both market and economic health.

**DISCLAIMER: THIS CONTENT IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE INTERPRETED AS INVESTMENT ADVICE. INVESTING INVOLVES RISK, INCLUDING THE POTENTIAL LOSS OF PRINCIPAL. READERS ARE ENCOURAGED TO CONDUCT THEIR OWN RESEARCH AND CONSULT WITH A QUALIFIED FINANCIAL ADVISOR BEFORE MAKING ANY INVESTMENT DECISIONS.**