AMD Maintains Strong Performance Amidst Industry Growth

Advanced Micro Devices (AMD) has recently concluded a trading session with a slight uptick in its share price, settling at $168.42, which represents a modest increase of +0.14%. This increment trails the S&P 500’s gain of 0.29% for the same period. Concurrently, the Nasdaq index experienced an ascent of 0.43%, while the Dow Jones Industrial Average saw a marginal decline of 0.25%. Over the preceding month, the semiconductor manufacturer’s stock has appreciated significantly by 20.47%, outperforming both the Computer and Technology sector’s gain of 3.67% and the S&P 500’s rise of 2.08%.

The company is on the cusp of releasing its earnings report on January 30, 2024. Expectations for the report are set with an earnings per share (EPS) projection of $0.77, which would mark an 11.59% increase from the corresponding quarter of the previous year. Revenue forecasts are also optimistic, with projections indicating a 9.2% increase to $6.11 billion from the same quarter of the prior year. The forthcoming earnings announcement is garnering significant attention, as it will shed light on the company’s recent performance and operational efficiency.

Recent shifts in analyst estimates for AMD signal a dynamic business environment and potential changes in short-term business trends. Analysts’ positive revisions of estimates are often indicative of growing confidence in the company’s business outlook. Currently, the company holds a Zacks Rank of #3 (Hold), a designation that forms part of a model designed to forecast stock performance based on changes in earnings estimates.

In the realm of valuation, AMD’s Forward Price-to-Earnings (PE) ratio is positioned at 46.3, surpassing the industry average of 29.5. The company’s Price/Earnings to Growth (PEG) ratio stands at 3.61, which is above the Electronics – Semiconductors industry average of 3.13. This industry is a segment of the broader Computer and Technology sector, which has a Zacks Industry Rank of 108, placing it within the top 43% of more than 250 industries. This ranking system suggests that industries with higher ranks are likely to outperform those with lower rankings.

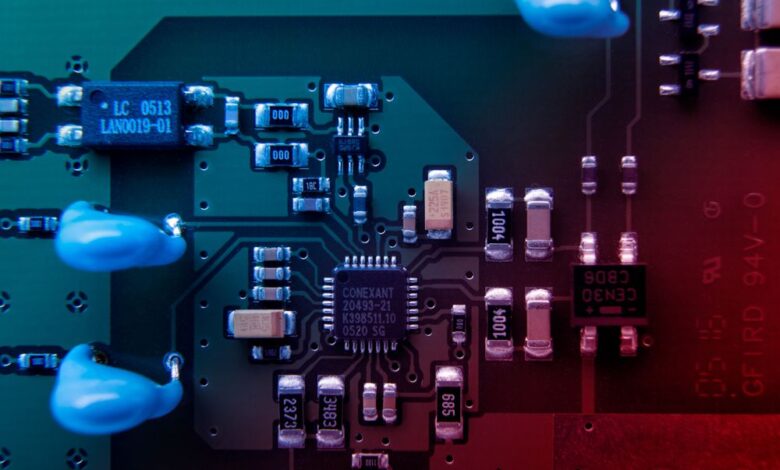

The company’s strides in the artificial intelligence (AI) chip market are also drawing attention. Industry analysts are acknowledging the increasing relevance of AMD’s contributions to this burgeoning field. As the demand for sophisticated computing capabilities escalates, the company’s role in delivering AI solutions is becoming more pronounced.

AMD’s recent stock market performance mirrors its consistent growth and the favorable assessments of industry analysts. The imminent earnings report is highly anticipated, promising to provide additional clarity on the company’s financial standing and strategic trajectory. With a robust foothold in the semiconductor industry and progress in artificial intelligence, the company continues to affirm its value through solid operational outcomes and industry rankings. As the technology landscape advances, the firm stands as a pivotal entity in fostering innovation and catering to the needs of a progressively digital society.

Source link