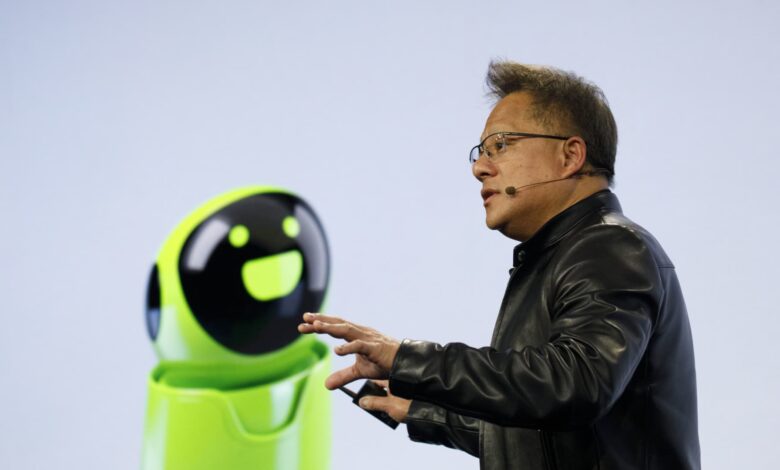

Jim Cramer says Nvidia CEO Jensen Huang is a bigger visionary than Elon Musk

CNBC’s Jim Cramer said Thursday he believes Jensen Huang — the co-founder and CEO of leading artificial intelligence chipmaker Nvidia — is a bigger visionary than billionaire entrepreneur Elon Musk, whose panoply of companies includes Tesla , rocket maker SpaceX and brain-tech startup Neuralink. “I think that Musk can see around the corner, but I think that Jensen is thinking about a legacy of changing the entire paradigm about the way the world is,” Cramer said Thursday on “Squawk on the Street.” Cramer’s Charitable Trust, the portfolio used by the CNBC Investing Club, has long been invested in Nvidia. Cramer has espoused the brilliance of Huang for years and even re-named his dog Nvidia. Cramer has likened Huang to Leonardo da Vinci . Ahead of earnings this time, Cramer equated Huang to popstar Taylor Swift , saying their success is unparalleled in their respective fields. “Jensen is creating, singlehandedly, an industrial revolution. And Musk is creating, singlehandedly, a way to be able to deliver things,” Cramer continued. “Those are both brilliant things, without a doubt, but to create an industrial revolution yourself — to create the loom, to create the train, to create the steamboat — who does those things?” Cramer’s comments came after Nvidia’s quarterly earnings report a night earlier exceeded Wall Street’s sky-high expectations. The AI chip firm delivered better-than-expected results for the three months ended in January and issued strong guidance for the current quarter, offering evidence that the generative AI boom that’s been underway since the launch of ChatGPT in late 2022 is marching on. NVDA TSLA 5Y mountain Nvidia’s stock performance compared with Tesla’s over the past five years. Nvidia’s chips — known as graphics processing units, or GPUs —are at the heart of the boom, providing the computing power needed to train the models underpinning ChatGPT and other AI applications. Demand for Nvidia’s products has far exceeded supply over the past year as cloud-computing providers like Microsoft and other companies invest heavily in the technology. Huang co-founded Nvidia in 1993. Its GPUs were initially used to render graphics for video games, but their potential for AI applications became widely apparent in the 2000s, setting the stage for the explosive growth the company has seen in its data-center business in recent years. In the 12 months ended Jan. 28, Nvidia’s revenue more than doubled from a year ago to $60.9 billion. Nvidia’s valuation has soared, too. The Santa Clara, California-based firm is the third-most valuable company in the S & P 500 , with a market capitalization of nearly $1.9 trillion, based on Thursday’s stock price. Its market value trails only Microsoft and Apple , both of which Cramer’s Trust owns. Tesla, which also is among the most valuable U.S. companies, carried a market cap of around $615 billion Thursday. Over the years, Cramer has certainly given Musk his due, calling out the Tesla CEO’s mercurial genius, incredible work ethic, and the way he brings attention to his companies. In 2019, Cramer said Musk is the P.T. Barnum of our time . Barnum’s exploits in the mid-to-late 1800s, as the master promoter of what became the Ringling Bros. and Barnum & Bailey Circus. Of course, since then, Musk has bought Twitter. And, renamed it into X.

Source link