Advanced Micro Devices, Inc.: Navigating Challenges Amid a Strong Market Position

$AMD

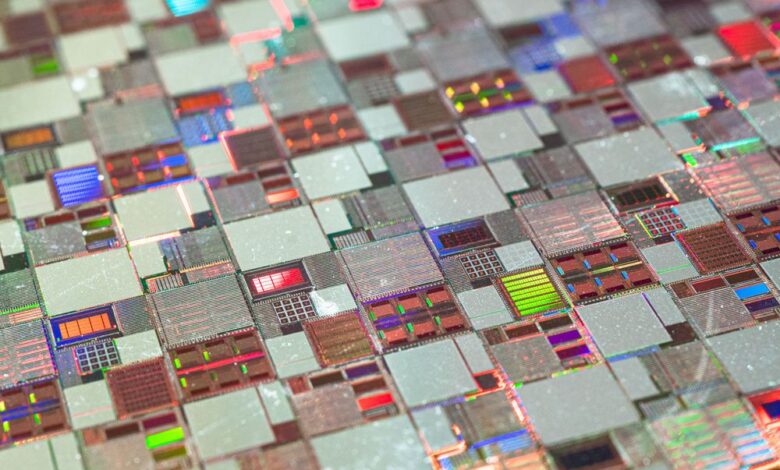

Advanced Micro Devices, Inc. (NASDAQ: AMD) remains a prominent player in the semiconductor industry, renowned for its high-performance CPUs, GPUs, and FPGAs. However, despite significant technological advancements and a robust market presence, the company has faced increasing challenges impacting its stock performance. Recent analysis, including insights from financial commentator Jim Cramer, sheds light on AMD’s current position and the hurdles it must overcome to maintain its competitive edge.

AMD’s growth in key sectors, particularly the data center and gaming markets, has been a bright spot for the company. Its EPYC server processors have significantly expanded market share, driven by heightened demand for cloud computing and AI applications. Additionally, the strong reception of Radeon graphics cards underscores AMD’s solid footing in the gaming industry, further cementing its reputation as a leading innovator in high-performance computing.

Strategic partnerships with major cloud service providers have bolstered AMD’s position, unlocking new revenue streams in AI and machine learning. The company’s ongoing investments in research and development have also been instrumental in maintaining competitiveness in both the CPU and GPU markets. Recent product launches and collaborations in the AI space have sparked optimism about AMD’s future growth prospects, reflecting its commitment to innovation and market relevance.

Despite these promising developments, AMD’s stock has been volatile, reflecting investor uncertainty about the company’s competitive positioning, particularly against NVIDIA. After a strong start to the year, AMD experienced a stock downturn as investors scrutinized its AI compute market strategy relative to NVIDIA’s increasingly comprehensive full-system solutions. The company’s recent adjustment of MI300 GPU chip revenue expectations to “greater than $4 billion” from the previously projected $3.5 billion, while positive, fell short of investor hopes, contributing to the market’s lukewarm response.

Jim Cramer’s analysis highlights that AMD’s stock has remained essentially flat throughout 2024, despite its fierce rivalry with NVIDIA in the AI space. Cramer attributes some of the stock’s struggles to broader market dynamics, particularly shifts in Federal Reserve interest rate policies. He notes that tech stocks like AMD typically perform well when rates remain high and the economy slows, but rate cuts shift investor focus to companies that can demonstrate rapid earnings growth, creating volatility for stocks like AMD.

Looking ahead, AMD must navigate these economic and competitive pressures while capitalizing on its strengths in AI and high-performance computing. The company’s ability to sustain growth will hinge on its strategic initiatives, including product innovation and market expansion in AI-driven technologies. As the broader tech landscape evolves, AMD’s agility in responding to competitive pressures and economic shifts will be critical to maintaining its leadership and driving future success

**DISCLAIMER: THIS CONTENT IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE INTERPRETED AS INVESTMENT ADVICE. INVESTING INVOLVES RISK, INCLUDING THE POTENTIAL LOSS OF PRINCIPAL. READERS ARE ENCOURAGED TO CONDUCT THEIR OWN RESEARCH AND CONSULT WITH A QUALIFIED FINANCIAL ADVISOR BEFORE MAKING ANY INVESTMENT DECISIONS.**