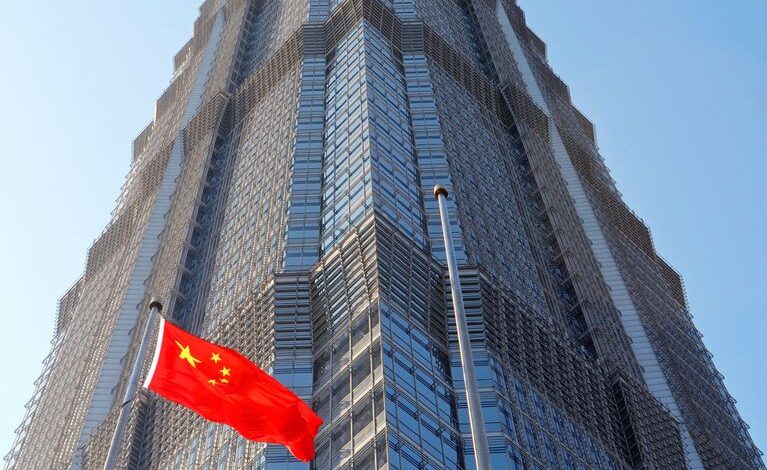

China Construction Bank Spearheads Innovative Financial Initiatives In Singapore And Beyond

$0939.HK

In a series of strategic moves that underscore its commitment to innovation and sustainability, China Construction Bank Corporation (CCB), a major global banking entity, has recently launched significant initiatives in Singapore, aiming to foster technological and green financial advancements. These efforts are part of the bank’s broader strategy to integrate digital solutions into financial services and promote sustainable development across its operations.

Late April witnessed CCB Singapore orchestrating two pivotal events under the banner of Business China’s Advanced Leaders Programme (ALP). The first event, themed “A Smart CCB, Connecting Sino-SG,” was held at CCB’s Shenzhen Tech-Innovation Branch. This gathering saw the participation of Dr. Koh Poh Koon – Senior Minister of State for Manpower and Sustainability and the Environment, alongside other notable figures. The event showcased discussions on technological advancements, including the introduction of digital renminbi (eCNY), which marks a significant step in digital currency adoption. The attendees, including nearly 30 ALP students and alumni, experienced firsthand the convenience of eCNY through interactive sessions where they made purchases using the digital currency.

Following this, CCB Singapore hosted a forum in Chengdu focused on green finance, highlighting the bank’s dedication to supporting sustainable economic growth. The forum featured influential speakers who discussed the integration of green financial practices within the broader framework of China’s economic development strategies. These discussions emphasized the importance of sustainable practices in achieving long-term economic stability and growth.

In a parallel development, CCB Singapore announced a collaboration with Gprnt, a platform launched by the Monetary Authority of Singapore (MAS), to enhance ESG data interoperability and support SMEs in their green transformation efforts. This partnership is poised to streamline ESG reporting and facilitate better access to sustainable financing, reflecting CCB’s proactive approach in addressing the environmental challenges through innovative financial solutions.

As CCB continues to expand its influence and operations globally, its focus on sustainability and innovation remains evident. These strategic moves not only enhance the bank’s competitive edge but also contribute positively to the broader financial and environmental landscape. Through such initiatives, the industry reaffirms its position as a key player in the global banking sector, committed to advancing economic and environmental well-being through innovative and sustainable practices.