Exploring Coupang’s Strategic Moves Amidst Market Challenges

$CPNG

Coupang, Inc. (NYSE:CPNG), a prominent player in the e-commerce market, has recently been the subject of significant attention due to its strategic initiatives and market performance. The company prepares to release its latest earnings report, stakeholders and market watchers are keenly observing its progress and strategies in the highly competitive e-commerce landscape. The company has been known for its dynamic approach to the e-commerce sector, primarily focusing on South Korea, where it has established a robust market presence. The company has innovated with its end-to-end logistics network, which promises delivery within hours across the nation, setting a high standard in customer service and operational efficiency. This capability not only enhances customer satisfaction but also positions Coupang favorably against competitors in the region.

The company’s recent financial performance reveals a pattern of growth, with a reported revenue increase of 23.2% year-over-year, amounting to $6.56 billion. This growth is a testament to Coupang’s strong market strategies and its ability to adapt to consumer needs. Moreover, the firm has not only met but exceeded revenue expectations, which reflects positively on its financial health and operational capabilities.

Looking ahead, analysts are projecting a continued upward trajectory for Coupang, with revenue expected to grow by 20.8% year-over-year to $7.01 billion. This anticipated growth is based on the company’s consistent performance and strategic expansions into new service areas, including food delivery and video streaming. Such diversification is likely to open new revenue streams and reduce dependency on traditional e-commerce.

In addition to its core e-commerce operations, Coupang is making significant inroads into technology investments, particularly in artificial intelligence (AI). The company is employing AI to streamline its logistics and delivery processes, which is expected to improve efficiency and reduce operational costs. These technological advancements are not only expected to bolster the market position but also enhance its competitive edge in the industry.

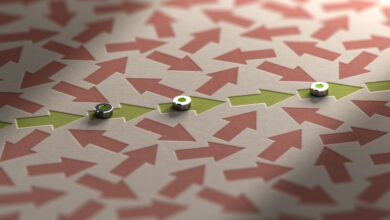

Coupang faces challenges typical of the e-commerce sector, including intense competition and the need to continuously innovate. The industry’s strategy includes expanding its service offerings and enhancing its technological infrastructure, which are crucial for maintaining growth and customer engagement in a rapidly evolving market. As the firm approaches its earnings release on May 7, 2024, the market is watching closely. The company is forecasted to report an EPS of $0.06, which would represent a 20% increase from the same quarter in the previous year. Additionally, the expected annual earnings growth and revenue projections suggest a strong fiscal year ahead for Coupang.

Coupang’s strategic initiatives and robust performance highlight its resilience and adaptability in the competitive e-commerce landscape. The company continues to expand its technological capabilities and diversify its service offerings, it remains a significant entity in the market, poised for continued growth and innovation. The upcoming earnings report will provide further insights into the strategic direction and its impact on the broader e-commerce industry.