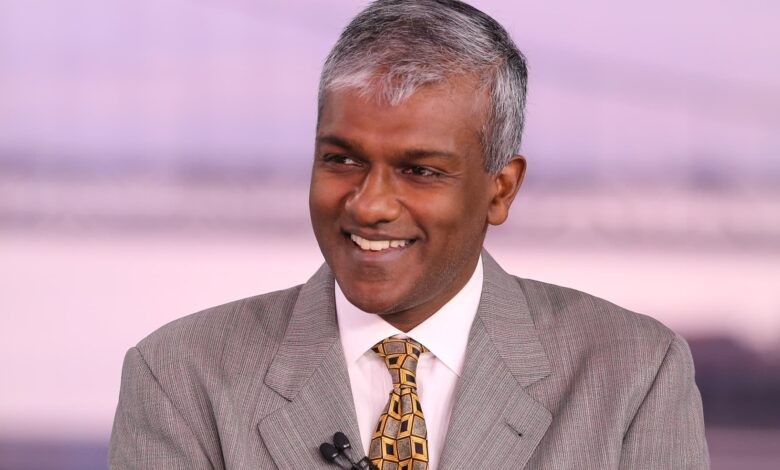

Here’s what hedge fund investor Dan Niles is buying right now

Hedge fund investor Dan Niles sees a buying opportunity in small-cap and consumer staples stocks right now. The Russell 2000 , the barometer for small-cap stocks, is now up about 1% in 2023. The index is on a tear, posting four consecutive winning days, after turning negative for the year last week. “A few days ago … we bought a massive slug of stocks in the Russell 2000,” Niles, founder and senior portfolio manager of the Satori Fund, said in an interview on CNBC’s ” Squawk Box ” on Tuesday. .RUT YTD mountain Russell 2000 year to date He is also in consumer staples stocks, which gives him a little bit of defense as well, he said. The fourth-largest weighting in Satori Fund’s consumer staples basket is PepsiCo , Niles said. The beverage giant’s stock was up 1% in midday trading after Pepsi reported a quarterly earnings and revenue beat before the bell. “That’s what I want to be in between now and year-end, especially with the geopolitical risk,” Niles said, referring to the Israel-Hamas war . Niles’ tech picks Meanwhile, Niles sees an uphill battle for big tech. The dollar is up 6% since mid-July, which will be a big headwind for fourth-quarter guidance and beyond for the so-called Magnificent Seven tech giants: Tesla , Amazon , Microsoft , Nvidia , Apple , Meta and Alphabet . The companies get about 53% of their revenue from outside the U.S., he said. On top of that, the Magnificent Seven are up 96% year to date, on average, Niles noted. Therefore, he thinks it is going to be hard for them to drive the market much higher. “We think the market is going to go up between now and the end of the year, most likely,” Niles said. “Looking at tech stocks, given the headwind they have, you are asking for a lot between now and year-end.” In this environment, he’s long on Nvidia and Alphabet. “Those are the two we feel confident their beat and raise quarters are coming,” he said. He is short on Tesla and Apple.

Source link