Other

Linde shares bounce on earnings, as margin expansion overshadows slight sales miss

Linde’s superb quarterly results demonstrated once again why this is our favorite way to invest in the global transition to clean energy. Sales totaled $8.16 billion fell 7.3% year over year in the three months ended June 30, missing analyst expectations of $8.6 billion, according to LSEG, formerly known as Refinitiv. Adjusted earnings per share (EPS) rose 17.1% and topped expectations, coming in at $3.63 compared with estimates of $3.57, according to LSEG. Adjusted operating profit jumped 14.7% to $2.31 billion, exceeding the $2.27 estimate. LIN YTD mountain Linde YTD Bottom line Industrial gas giant Linde (LIN) delivered the kind of quarter we’ve come to expect: Double-digit earnings growth and a lift to its profit guidance. While the top-line sales figure was light, Linde’s strong operating margin expansion in the quarter more than made up for it. “The margins are helping Linde” shares outperform the market Thursday, Jim Cramer said on the Morning Meeting. Shares of Linde are up roughly 14% year to date, compared to a loss of 3% for the S & P 500 Materials Sector . Linde shares on Thursday afternoon were up 2%, and trading at roughly 5% below its all-time high of $393.67 per share, set on Aug. 1. We were also encouraged by management’s commentary on clean energy projects, as companies look to lower their carbon footprint. Looking out a decade, the team maintained its belief in about $50 billion in clean energy opportunities, with between $9 billion to $10 billion over the next few years. “We own a lot, and we should continue to own a lot of Linde stock, ” Jim said. In good economic times and bad, Linde’s model of continued margin expansion with project growth has enabled earnings per share growth of at least 10% annually. We expect this will continue in the years ahead, especially as the company lands more clean hydrogen projects. Quarterly commentary There’s no need to panic about Linde’s top-line miss in the third quarter. At a high level, the same element in Linde’s contracts that last year allowed it to pass through soaring energy costs to its customers are now working the other way. That’s translating to a lower revenue number, but crucially this had “no effect on profit,” as CFO Matt White explained on the conference call Thursday. Linde’s underlying sales — which remove the variable energy costs — rose 3% in the quarter. While volumes were down two percentage points, Linde benefited from higher realized prices and contributions from its project backlog. Linde’s industrial gases, such as oxygen and nitrogen, are used in a range of industries and facilities, including hospitals and semiconductor factories. “When you read the news or government statistics, I know it’s hard to be bullish on the global economy,” Linde’s chief executive Sanjiv Lamba said on the call. “However, when looking at underlying trends by end market, we see a mixed picture with some increasing, while others are flat or slightly down.” One market that was down in the quarter was electronics, which declined in the mid-single-digit percentages, Lamba said. However, he said he sees the weaker parts of its electronics business beginning to recover in the first half of next year, as inventory levels stabilize and artificial intelligence boosts demand for the products Linde’s customers make. As noted earlier, third-quarter adjusted operating margins were very strong — coming in at 28.3% compared with Wall Street’s estimate of 26.3%, according to FactSet. In the same period a year ago, Linde’s operating margin stood at 22.8%. Linde’s after-tax return on capital — a measure of corporate health — ended the third quarter at 25.6%, another record high after besting the 24.9% recorded in Q2. Linde’s backlog increased $300 million sequentially to $8.1 billion, split between $3.6 billion in SOP (sale of plant or projects) and $4.5 billion in SOG (sale of gas). While higher global interest rates carry this risk of projects getting delayed or outright canceled, this should not be an issue for Linde. The company points out that its project backlog “is unique and the most stringent in the industry. Inclusion requires assured growth, a customer contract with fixed fees, and explicit termination provisions to ensure investment returns.” In addition, Linde points out that a sale of gas backlog between $3.5 billion to $4.0 billion historically contributes 2% of annual EPS growth. That means the current backlog of $4.5 billion should be worth a few percentage points of earnings growth next year. Guidance Linde now sees full-year earnings per share between $14 and $14.10, which would be a 14% to 15% increase compared with year-ago results. Previously, Linde’s full-year EPS guide had a range of $13.80 to $14. As usual, the upper end of Linde’s guidance includes no improvement in the global economy. Linde sees fourth-quarter earnings per share falling to between $3.38 and $3.48, compared with the $3.46 consensus estimate from analysts. On a constant currency basis, the midpoint of the fourth-quarter EPS guidance is down 4% compared with the three months ended Sept. 30. Management said a number of factors are contributing to that sequential decline, including its engineering unit, project timing and some seasonal factors. However, management said it’s taking steps to improve the EPS range. (Jim Cramer’s Charitable Trust is long LIN. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

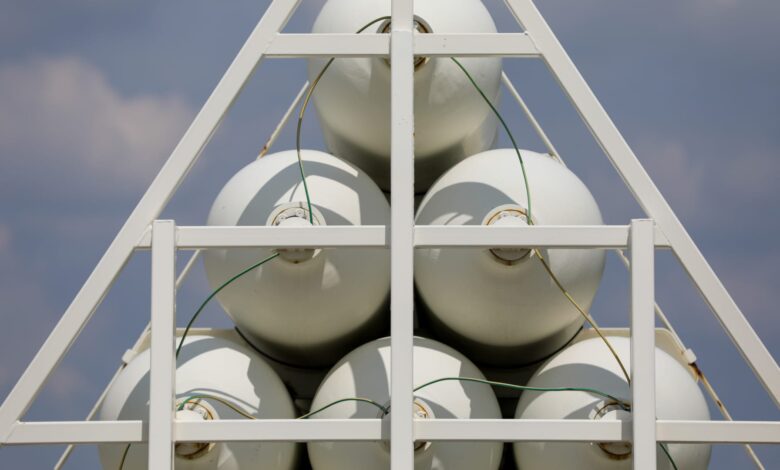

Tanks of hydrogen stand near a hydrogen electrolysis plant.

Bloomberg | Bloomberg | Getty Images

Linde’s superb quarterly results demonstrated once again why this is our favorite way to invest in the global transition to clean energy.

Source link

Post Views: 222