Mercedes-Benz and Rohlik Group: Strategic Expansion and Financial Growth

$MNTA

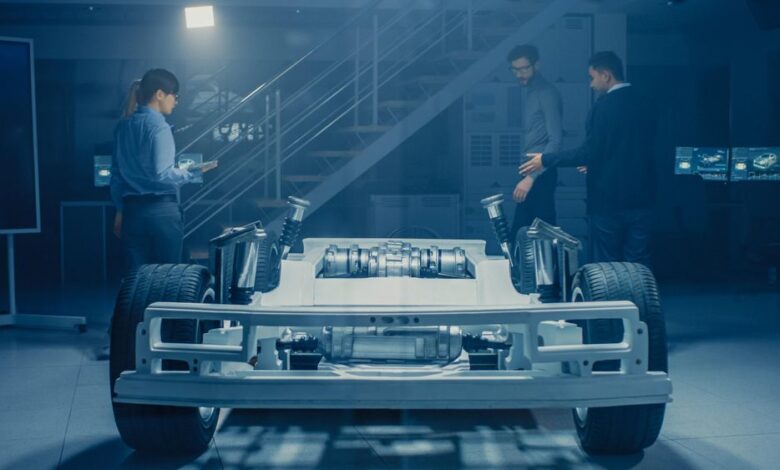

Mercedes-Benz (ETR: MBG) has recently partnered with Momenta (NASDAQ: MNTA), a Chinese autonomous driving startup, to strengthen its position in China, the world’s largest automotive market. This collaboration is part of a broader strategy to regain market share through significant investments in technology and innovation. The integration of Momenta’s advanced software into at least four upcoming models highlights the company’s commitment to leveraging cutting-edge technology to maintain its competitive edge, which was reflected in a stock price increase of 53.20 EUR, up 0.87 EUR (1.66%) over the past five days.

Financially, Mercedes-Benz has demonstrated strong performance with a continued free cash flow generation from its industrial business of €2.39 billion for Q3 2024, a slight increase from €2.35 billion in Q3 2023. This growth was driven by favorable working capital development, while net liquidity reached €28.73 billion, up from €28.49 billion a year ago. These figures indicate solid financial health and the company’s ability to capitalize on investments while maintaining financial stability.

Simultaneously, Rohlik Group, a leading player in the online grocery sector, has experienced significant financial growth, with its valuation rising to approximately 1.85 billion euros ($1.95 billion). This growth reflects the company’s rapid expansion over the past three years, supported by strong market performance and recent bond issuance. Rohlik’s success in adapting to the growing demand for online grocery shopping and efficient delivery services has played a key role in its rising valuation.

The strategic initiatives by both Mercedes-Benz and Rohlik Group highlight their focus on innovation and market adaptability. Mercedes-Benz’s focus on integrating advanced autonomous driving technology addresses the growing importance of software solutions in the automotive industry, especially in tech-driven markets like China. Meanwhile, Rohlik Group’s valuation surge showcases the success of its business model in the competitive online grocery market, driven by increased consumer demand for convenience and reliable delivery.

**DISCLAIMER: THIS CONTENT IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE INTERPRETED AS INVESTMENT ADVICE. INVESTING INVOLVES RISK, INCLUDING THE POTENTIAL LOSS OF PRINCIPAL. READERS ARE ENCOURAGED TO CONDUCT THEIR OWN RESEARCH AND CONSULT WITH A QUALIFIED FINANCIAL ADVISOR BEFORE MAKING ANY INVESTMENT DECISIONS.**