Navigating the Ebb and Flow of Stock Market Volatility

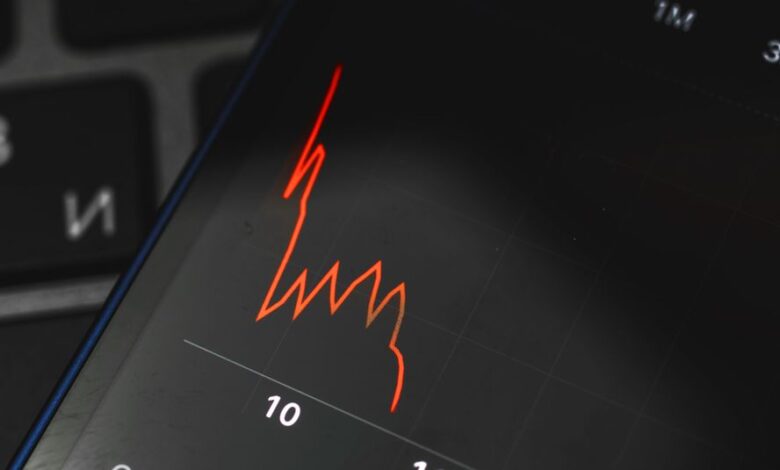

The financial landscape is a complex tapestry, woven with numerous elements that sway the performance of stocks, particularly those with a price tag below the $5 mark. These stocks are frequently at the mercy of significant volatility—a term that stands at the core of financial discussions, denoting the intensity of price swings experienced by a stock.

When it comes to stock evaluation, two methodologies stand out: fundamental analysis and technical analysis. The former delves into a company’s fiscal well-being, scrutinizing aspects such as profitability, cash flow, and debt management. The latter, technical analysis, takes a different approach by dissecting the stock market’s past performance to discern trends and patterns in share prices. This method employs a variety of metrics, including moving averages and relative strength indicators, to capture the essence of price movements and to forecast future trajectories.

Within the realm of technical analysis lies the beta coefficient, a measure that examines the correlation between a stock’s price volatility and a benchmark index. This coefficient offers a glimpse into how a stock’s price may dance in tandem with or against the broader market currents. Stocks that are highly volatile may tantalize with the prospect of substantial gains, yet they also bear the brunt of increased risk, as their price movements are more pronounced.

The stock market is inherently volatile, a characteristic that can trigger swift changes in investor sentiment and behavior. For example, a sharp increase in share prices may ignite a wave of optimism, while a downturn could lead to a rapid sell-off as market participants scramble to mitigate losses. Historical analysis reveals that over long stretches, such as a 30-year span, the stock market has generally provided average total returns of 11.1%, with a standard deviation that suggests a lower volatility level compared to other investment avenues, such as the bond market.

At present, the broader stock market is navigating through the tail end of a cycle characterized by swift interest rate hikes. Economic indicators hint that this phase might be nearing its conclusion, heralding a potential shift in the market’s rhythm. Such transitions can profoundly affect the performance of stocks, especially those known for their susceptibility to high volatility.

The essence of volatility is indispensable for grasping the nuances of stock market behavior, more so for stocks with a lower price point. Both fundamental and technical analyses provide the means to evaluate and anticipate stock performance, with beta playing a pivotal role in understanding a stock’s reaction to market trends. Historical data sheds light on the market’s long-term yield, while current economic signals indicate a possible change in the financial climate, which could reshape the market’s future contours. As the market perpetually transforms, these insights are vital for decoding the intricate dance of stock performance and market vicissitudes.

Source link