Taiwan Semiconductor Manufacturing Co. Sees Surge In AI Chip Production Amidst Market Recovery

$TSM

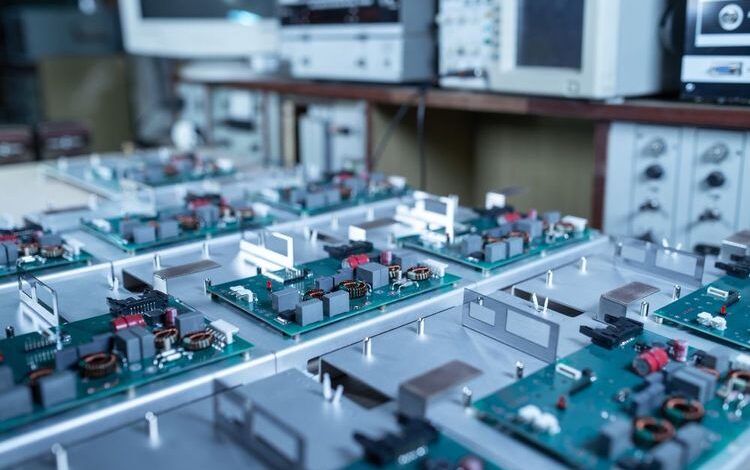

Taiwan Semiconductor Manufacturing Company (NYSE:TSM), commonly known as TSMC, stands as the world’s premier semiconductor foundry. Specializing in the manufacture of integrated circuits and related services, TSMC is pivotal in the global supply chain, serving major tech companies across various industries. Its dominance is marked by advanced technology and substantial market share, positioning it as a critical player in the tech sector, especially amidst the rising demand for more sophisticated semiconductor solutions.

Taiwan Semiconductor Manufacturing Co. has reported a significant uptick in its operations, particularly in the production of AI chips, which has led to a notable increase in revenue. In May, the company’s sales soared by 30%, reaching approximately $7.1 billion. This growth is largely attributed to the robust demand for AI technologies and a recovery in the consumer electronics sector. TSMC, the world’s largest contract chipmaker, plays a pivotal role in the semiconductor industry by manufacturing chips for major tech companies like Nvidia Corp. (NASDAQ:NVDA), which in turn supplies entities such as Microsoft Corp. (NASDAQ:MSFT) and OpenAI. The resurgence in global smartphone sales earlier in the year also contributed to an increased demand for mobile chips, further boosting TSMC’s production output.

The company’s strategic position is strengthened by its high margins, particularly in the production of advanced AI accelerators for Nvidia and other semiconductors for industry giants such as Apple Inc. (NASDAQ:AAPL) and Advanced Micro Devices, Inc. (NASDAQ:AMD). TSMC’s CEO, C.C. Wei has expressed optimism about the ongoing development in AI technology, anticipating it to catalyze a sector-wide recovery by 2024. In line with this, TSMC is considering a price hike to leverage its competitive edge in the market. Looking forward, TSMC expects the semiconductor industry to grow by 10% annually in 2024, excluding memory chips.

This forecast is supported by the significant investments from major tech companies in generative AI technologies, which have nearly doubled the number of AI-focused startups, now termed ‘unicorns’, to 37 by the end of April. This represents an 85% increase from the previous year, with investments flowing from prominent players like Nvidia and Alphabet Inc. (NASDAQ:GOOG) (L). The global distribution of these new AI unicorns is also noteworthy, with ten of the seventeen new startups based outside the US, including in China and France. This diversification indicates a broadening interest and investment in AI technologies across various global markets, shifting focus from sectors like electric vehicles and fintech to AI. In the stock market, TSMC’s shares have seen a remarkable 62% increase over the last 12 months, highlighting investor confidence in the company’s growth trajectory. The broader semiconductor sector can also be accessed through investment vehicles such as the First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL) and the ProShares UltraShort Semiconductors (NYSE:SSG). As TSMC continues to capitalize on the expanding AI market, its strategic moves and robust performance are setting the stage for sustained growth and market leadership in the semiconductor industry.

**DISCLAIMER: THIS CONTENT IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE INTERPRETED AS INVESTMENT ADVICE. INVESTING INVOLVES RISK, INCLUDING THE POTENTIAL LOSS OF PRINCIPAL. READERS ARE ENCOURAGED TO CONDUCT THEIR OWN RESEARCH AND CONSULT WITH A QUALIFIED FINANCIAL ADVISOR BEFORE MAKING ANY INVESTMENT DECISIONS.**