Tower Semiconductor: Strategic Growth and Market Adaptation Amidst Global Challenges

$TSEM

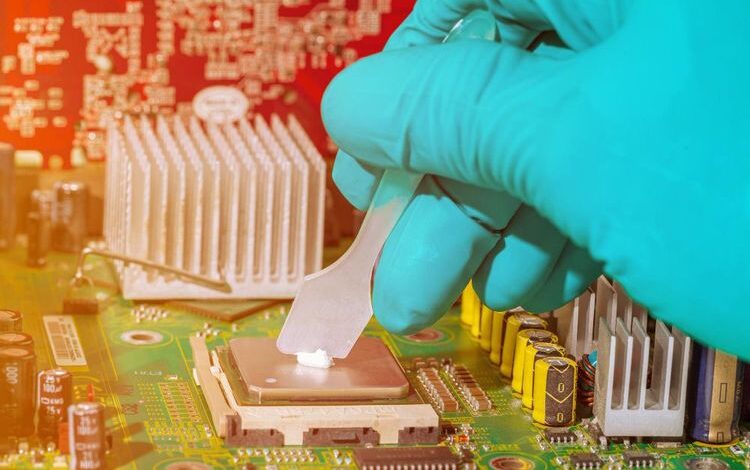

Tower Semiconductor (NASDAQ: TSEM) is a significant player in the global semiconductor industry, operating as an independent chip foundry based in Israel. Tower Semiconductor specializes in the manufacturing of analog-intensive mixed-signal semiconductor devices, with a client base that spans the United States, Japan, Europe, and other international regions. Additionally, the company offers design enablement platforms that facilitate efficient design cycles, thereby positioning itself as a crucial player within the technology industry’s supply chain.

Tower Semiconductor has adeptly navigated the complex global market landscape while focusing on strategic growth and technological innovation. In recent times, the company has reported a number of robust financial and operational developments, despite the prevailing global economic uncertainties. In the first quarter of 2024, Tower Semiconductor achieved revenues of $327 million, meeting market expectations despite fluctuations in demand for semiconductors. The company’s net profit was $45 million, with a notable net margin of 14%, which demonstrates effective operational efficiency and management.

Tower Semiconductor is financially robust, boasting total assets of $2.98 billion. This is supported by a comprehensive investment strategy that includes significant capital expenditure on new technologies and production capabilities. Notably, the company is enhancing its manufacturing prowess through substantial investments in its 12-inch factory in Agrate, Italy, and a strategic partnership with ST Microelectronics. Tower Semiconductor is a market leader in the field of radio frequency (RF) silicon-on-insulator (SOI) technologies and is actively expanding its presence in the rapidly growing 5G sector.

Furthermore, the company is making progress in the field of silicon photonics, which is of great importance for data centers and AI applications. This is evidenced by the company’s collaborations with leading optical integrators and its active participation in silicon photonics programs with industry leaders. Tower Semiconductor anticipates second-quarter 2024 revenues of $350 million, driven by increased production capacity and demand for specialized semiconductor solutions. Its proactive approach to navigating global semiconductor market dynamics serves to illustrate both the firm’s resilience and its strategic foresight.

DISCLAIMER: THIS CONTENT IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE INTERPRETED AS INVESTMENT ADVICE. INVESTING INVOLVES RISK, INCLUDING THE POTENTIAL LOSS OF PRINCIPAL. READERS ARE ENCOURAGED TO CONDUCT THEIR OWN RESEARCH AND CONSULT WITH A QUALIFIED FINANCIAL ADVISOR BEFORE MAKING ANY INVESTMENT DECISIONS.