Why investors should only trade a name like Linde on fundamentals

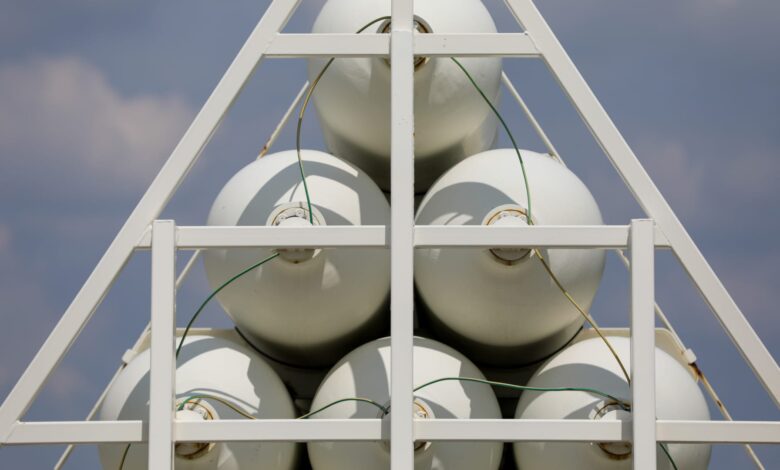

Every weekday the CNBC Investing Club with Jim Cramer holds a Morning Meeting livestream at 10:20 a.m. ET. Here’s a recap of Wednesday’s key moments. 1. U.S. stocks were slightly higher Wednesday morning as investors awaited the Federal Reserve’s latest interest-rate decision at 2:00 p.m. ET, with the S & P 500 and the Nasdaq Composite both up around 0.17% Wall Street widely expects the Fed to hold interest rates steady. But there will be a lot of focus on the so-called dot plots, which show the central bank’s expectation of where rates will be next year. Investors should be encouraged that inflation continues to decelerate, even with unemployment still very low, at 3.7%. Indeed, wholesale prices were flat in November, the Labor Department said Wednesday, pushing bond yields lower in midmorning trading. The yield on the 10-year Treasury was hovering above 4.1%. Oil prices gained around 0.8%, with West Texas Intermediate crude trading around $69 a barrel. 2. Club holding Linde did not get the nod to join the Nasdaq 100 . Instead, the index tapped Take-Two Interactive Software to replace Seagen . As a result, Linde is down roughly 3.7% Wednesday morning, giving up much of the $18 a share it gained Tuesday on speculation it could be added to the Nasdaq 100. That’s why we don’t like to chase stocks when they go up on non-fundamental reasons. But from a fundamental perspective, we still like the industrial gas giant very much and encourage investors to stick with it. 3. Oppenheimer removed Club name Costco from its “top pick” list, citing valuation, even as the firm maintained an outperform rating on the stock. Oppenheimer argued that Costco’s significant outperformance puts its relative price-to-earnings ratio above recent historical averages and consistent with historical peaks. Costco stock is up 37% year-to-date, compared with a 20% gain in the S & P 500. But Costco is too high quality of a name — a long term compounder — to try and trade around valuation. The wholesale retailer is set to report quarterly results after the closing bell on Thursday. (Jim Cramer’s Charitable Trust is long LIN, COST. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Source link